Hard data on co-operatives and mutuals in Australia is a little scarce. Perhaps it’s because they cover so much territory – from the very large to the very local. So some quick cuts from the CME database.

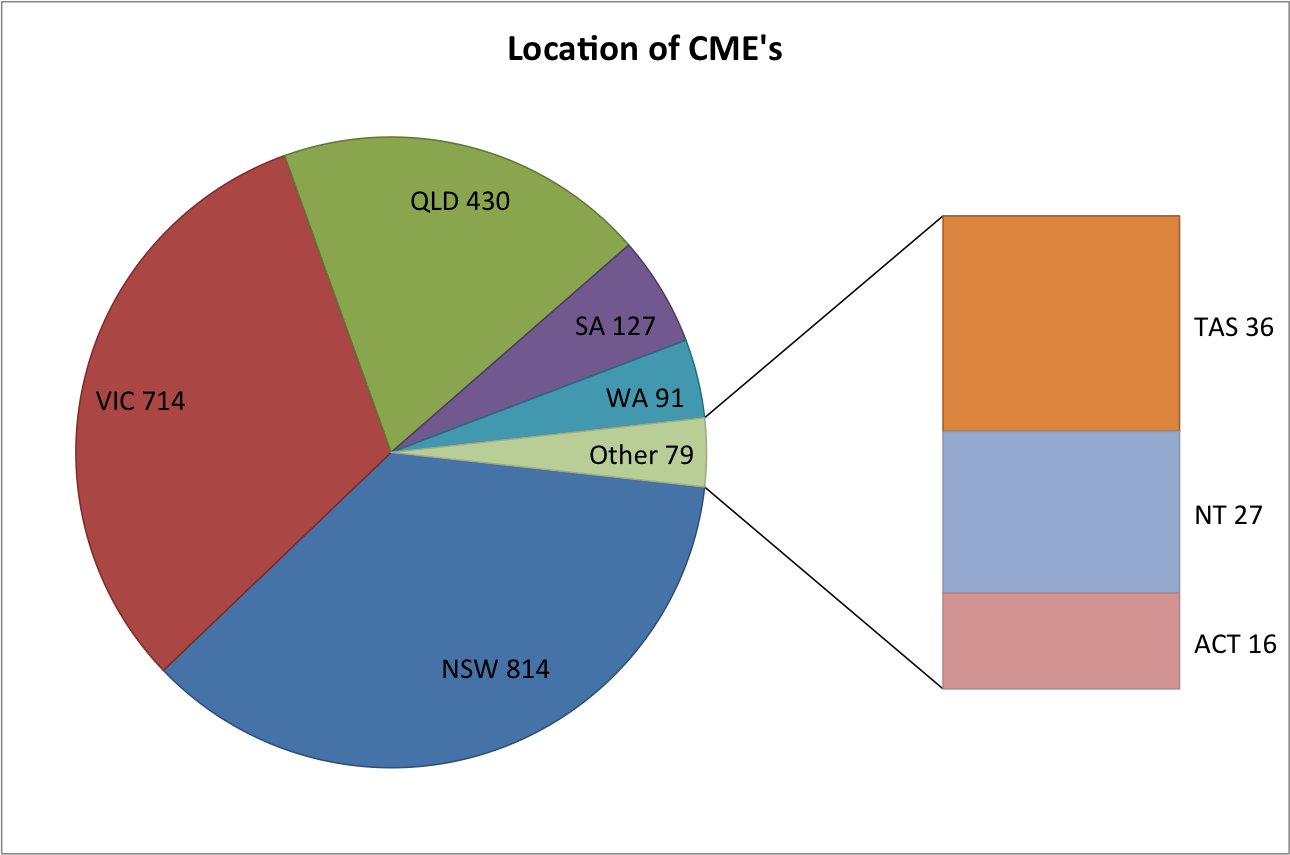

Not surprisingly the location breakdown of CME’s pretty much echos population density…

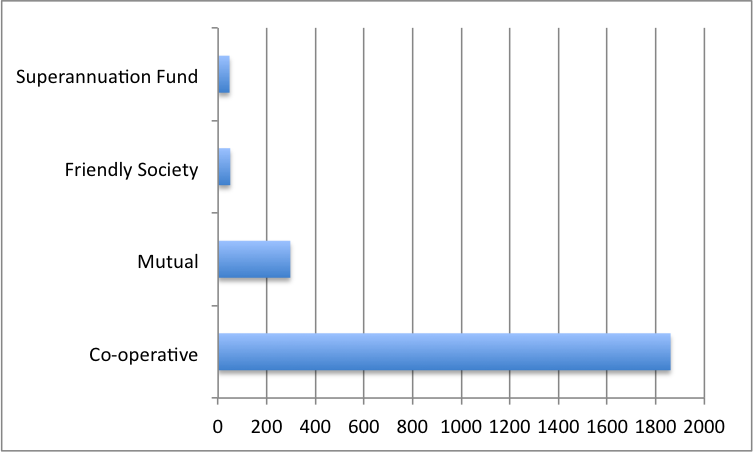

And the type is interesting insofar that if we mapped the same by assets or revenue rather than sheer number of entities, then it would be the exact opposite – superannuation funds would be the largest by a fair margin, then health funds… and coops.

What perhaps is more interesting is seeing how the breakdown by industry maps to emerging trends in the sector:

Emerging trends – consumer coops

- Community owned assets – The Housing and the Sports & Recreation sector are the most numerous by far – with groups as diverse as model railway operators to the Hells Angels using coops. They often use coops as a mechanism to gather management and ownership of shared infrastructure. We’re seeing emerging interest in the coop housing sector for this purpose from specific demographics such as aged care or respite.

- Shared financial services – still going strong when it comes to aggregating consumers money with financial services (aka credit unions, building societies, mutual banks etc), health insurance, superannuation funds. Merger activity and rebranding is often leading these entities to become increasingly remote from the constituencies that created them.

- Education, Training & Childcare – numbers are swelled by public schools using favourable legislative treatment to create coops for building projects. Having said that, the childcare sector is another where workers and community can come together the use the coop structure to deliver better outcomes.

- Information & Media – the community radio sector in Australia is huge with some 22,000 volunteers contributing over $300m in value to the community. Notably, the local and community nature of these operations has provided natural protection against the disruption that has been rippling through this sector.

- Retailing – community ownership of retailers is a growing category of coops. So while most retailing coops are community owned stores there is also an emerging recognition that promoting consumer-ownership is the best defence against online disruption. If we follow in the footsteps of the UK, then we can expect more retailers to be acquired via coops – such as pubs, service stations, your local bakery.

- Utilities – current energy retailers are pricing their offers to promote the emergence of community owned energy providers. We’re seeing wide interest across Australia in renewable energy projects that are likely to leverage the coop model.

Emerging trends – producer coops

- Agribusiness and Fishing – Some of Australia’s more prominent agricultural coops were demutualised recently (Murray Goulburn and Namoi Cotton). Whether their members were better served by the coop structure is a moot point. Conversely, the federally funded Farming Together Program has sparked another crop of coops into existence. They are yet to appear in the data. Perhaps the biggest emerging trend is this sector is the wave of new technology that is being propelled at farmers. The potential impact on farmers has encouraged many to consider the role of coops in helping them manage their data both individually and in aggregate.

- Arts & Culture – with 8% of the Australian workforce now part of the gig economy, we are expecting to see the arrival of platform coops that can help these workers to aggregate their needs and better protect their interests. As the Arts & Culture sector has a long history in using coops to manage resources, they could be well placed to emulate the SMartEU and Stocksy models in Australia.

- Wholesalers, Professional Services, Purchasing Services & Shared Services – the industry aggregator coop remains alive and well despite the best efforts of Amazon.